Survey conducted by Valencell and MEMS & Sensor Industry Group reveals consumer interest in monitoring advanced health metrics like stress, blood pressure, and sunlight exposure

A recent national survey on wearable technology devices (“wearables”) revealed that consumers consider accuracy the most important feature of wearables, and more than half of those who do not own a wearable would consider buying one if they trusted the accuracy. The survey findings were announced today by Valencell, the leading innovator in performance biometric data sensor technology, and MEMS & Sensors Industry Group, the trade association advancing Micro-Electro-Mechanical Systems (MEMS) and sensors across global markets.

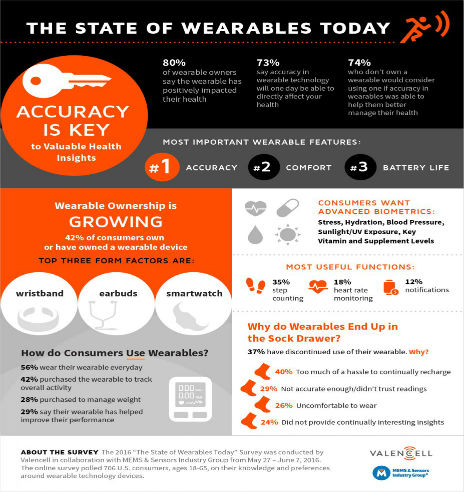

The online survey polled 706 U.S. consumers, ages 18-65, on their knowledge and preferences around wearables, which were defined as a device, clothing and/or accessories incorporating computer and advanced electronic technologies.

Among those surveyed, more than 42% of respondents own or have owned a wearable device, and the majority (63%) ranked accuracy as a highly important feature of that wearable. Among wearable owners, 80% feel that their wearable has a positive impact on their health. For those who do not own a wearable, 74% of would consider using one if accuracy in wearables could help them to better manage their health.

“These survey results are testament to Valencell’s view that accurate and interesting insights are critical to the success of the wearable industry, and are the biggest drivers of growth today,” said Dr. Steven LeBoeuf, President and Co-founder of Valencell.“More consumers than ever before are looking to biometric wearables to monitor their health and fitness, and wearables that cannot be trusted for accuracy will ultimately lose-out to wearables that have been properly validated.”

While most wearable owners find functions such as step counting, heart rate monitoring and notifications most useful, they would also like their wearable to monitor additional health metrics, including stress, blood pressure, sunlight/UV exposure, hydration, and key vitamin and supplement levels.

“MEMS and sensors are critical components in more accurate wearables,” said Karen Lightman, executive director, MEMS & Sensors Industry Group. “That’s because the devices themselves, from accelerometers, gyros and pressure sensors to heart rate monitors and environmental sensors are delivering ever higher levels of granularity while consuming less power in smaller footprints. Beyond accuracy, MEMS and sensors make wearables more interesting because they literally sense the world around us. With so much advanced functionality now at their disposal, I am convinced that wearables designers will introduce new and compelling products that consumers will consider “must-have” rather than just “nice-to-own.”

Key findings of the survey are below. An executive summary of the survey and infographic can also be found at valencell.com/blog.

Accuracy Trumps Cost as a Barrier to Wearable Ownership

Accuracy Trumps Cost as a Barrier to Wearable Ownership

Nearly half of all respondents own or have owned a wearable device, with the most popular form factors being wristbands, earbuds and smartwatches. Among notable findings:

42% of survey respondents own or have owned a wearable

Of those who own a wearable, 52% own a wristband, 36% earbuds and 32% a smartwatch

42% purchased the wearable to track overall activity and 28% purchased to manage weight

Of those who do not own a wearable, 31% do not own because they are too expensive and 28% do not own because they are not sure of the benefit of wearables; 58% would consider buying if they trusted the accuracy

Consumers Want More than Just Step Counting

Consumers who own wearables like to use the data provided to check on progress, and many feel that the wearable has helped improve their performance. While respondents find step counting and heart rate monitoring the most useful functions, they would also like to be able to monitor additional health conditions and metrics. These findings support anecdotal stories that consumers care less about the raw metrics and more about assessments derived from raw metrics. Among notable findings:

35% of wearable owners feel step counting is the most useful function; 18% find heart rate monitoring most useful; and 12% find the notifications most useful

When asked what type of condition they would like to monitor beyond what they are doing now:

55% would like to monitor stress

48% would like to monitor hydration

46% would like to monitor blood pressure

38% would like to monitor sunlight/UV exposure

35% would like to monitor key vitamin and supplement levels

When asked what they like most about their wearable:

62% like getting data and checking on progress

29% like that their wearable has helped improve their performance

27% like the accuracy of the data

Accuracy is Key to Valuable Health Insights

Accuracy, comfort, and battery life topped the list of highly important features in wearables. Of those who currently own a wearable, 80% feel that the wearable has positively impacted their health. Among notable findings:

63% of all respondents ranked accuracy as a highly important (critical) feature, followed by comfort (57%) and battery life (47%)

73% of all respondents believe that accuracy in wearable technology will one day be able to directly affect your health

80% of wearables owners feel that their wearable has positively impacted their health

More than 65% of respondents who do not own wearables would consider using one if it provided significant information on their health, including things like blood pressure, stress, and heart health

74% of respondents who do not own wearables would consider using one if accuracy in wearables was able to help them better manage their health

Recharge Hassles, Poor Accuracy and Comfort, and a Lack of Interesting Insights Cause Wearables to End Up in the Sock

Drawer

Of those who own wearables, more than half wear their device every day. However, more than a third have discontinued use of their wearable for reasons including the hassle of recharging the wearable and their perception that the wearable was not accurate enough and they didn’t trust the data. Among notable findings:

More than 80% have owned their wearable for more than six months

56% wear their wearable every day; 13% wear it once a week

37% have discontinued the use of their wearable

Of those who have discontinued using their wearables, 54% stopped using their wearable within 3 months or less

Top reasons for discontinuing use of a wearable:

40% Too much of a hassle to continually recharge

29% Not accurate enough (didn’t trust the readings)

26% Uncomfortable to wear

24% Did not provide continually interesting insights

About the Survey

The 2016 “The State of Wearables Today” Survey was conducted by Valencell in collaboration with MEMS & Sensors Industry Group from May 27 – June 7, 2016. The online survey polled 706 U.S. consumers, ages 18-65, on their knowledge and preferences around wearable technology devices.

About Valencell

Valencell develops performance biometric sensor technology and provides this patent-protected technology to consumer electronics manufacturers, mobile device and accessory makers, sports and fitness brands and gaming companies for integration into their products. Valencell’s PerformTek® biometric sensor technology employs active signal characterization, the process of segmenting raw signal data from biometric sensors into biological, motion, and environmental signals and noise.

Valencell’s inventions are currently found in wrist-, arm-, and ear-worn wearables and hearables. Valencell has invested years into the research and development of its PerformTek sensor technology, protected by dozens of granted patents and independently validated by the Duke Center for Living, North Carolina State University, the Human Performance Laboratory and a fellow of the American College of Sports Medicine. For more information, visit www.valencell.com.

About MEMS Sensor & Industry Group

MEMS & Sensors Industry Group (MSIG) is the trade association advancing MEMS and sensors across global markets. MSIG advocates for near-term commercialization of MEMS/sensors-based products through a wide range of activities, such as conferences, technical working groups and education. By bringing the TSensors® (Trillion Sensors) Enterprise under the umbrella of events and programs, MSIG also increases worldwide awareness of emerging MEMS/sensors-based applications with huge commercialization potential in the next decade and beyond.

Nearly 200 companies and industry partners comprise MEMS & Sensors Industry Group, including Analog Devices, ARM, Bosch, Cirrus Logic, EV Group, GE, GLOBALFOUNDRIES, HP, HTC Corporation, Huawei, Infineon, Intel, InvenSense, Kionix, Knowles Corporation, Lam Research, Lenovo, NXP, OMRON Electronic Components, Qualcomm Technologies, Inc., SONY Electronics, SPTS Technologies, STMicroelectronics, Texas Instruments and TSMC. For more information, visit: www.memsindustrygroup.org and follow MSIG on LinkedIn and Twitter (use @MEMSGroup).