A Report from TransTech Boulder

Part of the Transformative Technologies Community

PART ONE — HARDWARE PRODUCTS AND TECHNOLOGIES

INTRODUCTION

The Neurotech category within TransTech has been experiencing rapid growth in recent years. It comprises brain-computer interface (BCI) technology such as EEG and fMRI brain measurement and monitoring, along with a range of platforms and applications aimed at diagnosing, maintaining or treating mental health and wellbeing. As a technologist, I have been fascinated to watch the expected price/performance trends of the digital era (Moore’s Law and others) impact the Neurotech category, leading to wider availability and broader treatment options for such technologies beyond the inpatient care setting. I hope in this article to provide an overview and status update of the Neurotech sector, and provide some context for tracking these emerging sectors and the associated applications of such technology in mental health and wellbeing.

This is a field of endeavor that has spawned numerous start-ups, and is also seeing heavy investment from corporate health care companies. Among the TransTech sectors, Neurotech has perhaps a larger rate of participation among the university and non-profit sector, as will be seen in some examples below. The TransTech Boulder chapter is making a concerted effort to reach out to the university community in Colorado for just that reason. For example, the University of Colorado Anschutz Medical Center has launched a National Mental Health Innovation Center to help bridge and shorten the gap from research to scalable solutions addressing mental health conditions.

To attempt to illustrate the focus, I constructed the sample ecosystem diagram below. It comprises a mix of hardware and software technologies, applications, and other ecosystem support companies. It is far from comprehensive for a fast-growing space, but hopefully is illustrative.

Note — the diagram also includes the adjacent neuromodulation or Neurostim sector, although that sector will be the focus mostly of a future article. But there is some Neurostim discussion in this article, mostly to characterize how it is related to Neurotech, how it draws some significant media attention, and how it brings with it a different set of challenges that deserve their own focus.

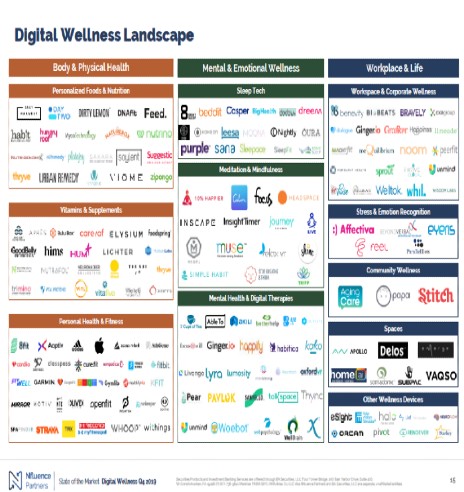

For a comparative view, the following graphic illustrates where some of the above companies fit within the larger TransTech focus areas and the digital wellness landscape in general.

With that as context, let’s look at some components of the BCI landscape.

EEG — CONSUMER PRICED TECHNOLOGY

Electroencephalography, or EEG devices, record electrical activity in the brain by means of electrodes placed on the scalp. EEGs have been historically used to diagnose a range of brain abnormalities or disorders. Over time, magnetic resonance imaging (MRI or fMRI) is used more often as it gives high-resolution, three dimensional views of brain activity. EEG has the advantage of being inherently mobile or available for outpatient use, and is orders of magnitude cheaper.

Costs continue to come down, and a new generation of companies has designed and marketed consumer-facing products for particular uses. These products are often purpose-built, and vary the number and position of electrodes to record different kinds of information. There are other variable design parameters such as sampling rate. The following section will first survey the hardware itself, and then illustrate some of the target applications.

Note — the term non-invasive is often used to distinguish EEG and other techniques measuring from the brain, as opposed to sending electronic signals into the brain. The latter types of devices, called neuromodulation or neurostimulation, often use the term non-invasive in the more traditional sense of non-surgical, but sending signals into the brain is certainly invasive in reaching below the surface of the skull, at least in the electro-magnetic sense.

FIRST GENERATION CONSUMER-PRICE EEG

The first generation of consumer-priced EEG devices emerged over the last ten years, include the more well-known Muse from Interaxon, the Emotiv, and OpenBCI. G.tec is not as well known in the U.S., but was one of the first to offer a home-use EEG system.

Some of these offer software development kits (SDKs) incorporating APIs, and make them available on a variety of licensing terms.

The Muse headset was introduced by Interaxon in 2009. (See picture.) It is a very lightweight device, and incorporates 7 sensors, or electrodes, in its latest model. The device records and displays data corresponding to the five types of brainwaves (characterized by frequency measured in Hertz) — Alpha Beta Gamma Delta and Theta — and can give some idea of the degree of relaxation of the user. With a first use as a meditation aid, it gives both a real-time readout or a summary readout after a session is complete. The visual feedback is supplemented by audio feedback — e.g. bird chirps — that become more frequent as the user maintains a state of greater calm, and thus provides real-time positive feedback. (A later section of the article will provide more on the use cases.) For the author, pictured wearing an earlier model, the benefit has been an extra motivation to actually sit down more often based on the positive reinforcement.

The company recently acquired Meditation Studio, a library of guided meditation recordings, to enhance the offering to a meditation audience. Interaxon also this year introduced a sleep headband to record brainwaves of the user while sleeping.

Emotiv, founded in 2011, provides a line of EEG devices under the EPOC brand name, from a low-end 5 channel headset (similar range as the Muse) for $299, up to a 32-channel skull cap. The company also provides software products including analytic neuroscience software. Licensing Emotiv technology for research comes with usage pricing.

OpenBCI started with a Kickstarter campaign in 2014. Their premise from the outset was to develop a low-cost EEG platform that anyone could use, and with a broad audience in mind developed its headset designs with an open source approach. Customers are able to buy assembled headsets and skull caps, but can also at a lower price buy blueprints and then use 3-D printers to print and assemble their own devices. While they still sell hardware products, their business model has gradually expanded to a consulting model, leveraging the early entry of its founders to offer broad expertise, and also leveraging a very large OpenBCI community forum of makers and experimenters who tinker with and extend the platform, and share their questions and results. Several of what I call second-generation companies described below are built on the OpenBCI platform, which offers relatively lean licensing terms.

G.tec Medical Systems may have a legitimate claim to be the first home-use system, introduced in 1999. The company has a range of headsets under the Nautilus brand name, and also offers a host of supporting technology including electrode systems, bio-signal amplifiers and software. The company’s most ambitious offering is the mindBEAGLE system, a portable BCI product for assessment of patients in comas or who are “locked in.”

The companies’ products tend more toward the medical/clinical market, but has just jumped on the recent bandwagon to offer the Unicorn Brain Interface, to allow users to use the headset “to write, draw, control robots and more just by thinking!” This type of application to control external devices is common to several second- generation devices, which not surprisingly have shown up as exhibits at the annual Consumer Electronics Show.

SECOND GENERATION CONSUMER-PRICE EEG

A second generation of such devices has emerged in recent years. This is a grouping meant to just group more recent market entrants, not to imply their devices are more technically advanced than the first generation.

NextMind, a first-time exhibitor at CES, is developing a small and discrete, non-invasive brain-sensing device for the mass market. The NextMind product targets control of game devices, computers, mobile devices and VR/AR headsets. The form factor of a headband allows use together with VR goggles. NextMind is offering a developers’ kit to “select developers and partners” in mid-2020 for $399.

These devices actually translate the sensing of a users’ visual attention into output signals that, for example, zap a video game monster that you are focused on. In this sense, it competes with eye-tracking technology which is more fully developed in the assistive technology world to operate a computer interface for messaging.

BrainCo is company that returned to CES for a second time, a much larger and more polished booth presence than the previous year. Their new generation headset was being marketed to run games. The previous year showcased an app to control a prosthetic hand, and this year that prototype became a spin-off product. Built-in AI and deep learning is utilized for neurofeedback to gradually gain better control of the prosthetic.

It’s worth noting that direct translation of mental command of motor skills to a prosthetic device is still not well understood; what happens in the use of this product is that the hand is connected to the remaining nerve endings of the patient’s arms, and through practice the user’s brain rewires itself to leverage just those nerve endings to move the hand.

The headset is cheap (under $300 for headband plus lifetime subscription to the app), but the prosthetic arm when released will likely be offered as part of medical treatment, with associated FDA approval and insurance reimbursement.

Sens.ai is a headset developed by a founder who herself has been a concussion and PTSD patient. The price point $695 (3 sensors). It has been angel funded to date, and is just coming to market now.

NeuralFlex offers an EEG headset and a variety of related Apps, characterized as a “hybrid intelligence integrated solution supplier.” According to the company, the product blends neuroscience, signal processing and communication, deep learning, and control theory. There are virtual reality and mobile game experiences, and even the ability to control drones. An SDK is available. The design and $199 price point are similar to the Muse. The company is based in Shenzen, China.

WAVi Medical is primarily in the non-D2C market, offering an FDA-cleared, 10–20 position EEG device which qualifies for insurance reimbursement. As prescribed by physicians, an in-office scan using this device costs $80, compared to a hospital EEG at $300. It is used for assessment of cognitive decline or concussion recovery. This product grew out of Nobel Laureate Tom Cech’s Biofrontiers Institute at the University of Colorado.

Also, the WAVi Performance side of the business offers a product to the athletic performance market, and market a training system. The consumer facing side pays attention to design, as can be seen by the Italian-design version that is pictured below.

FUNCTIONAL MAGNETIC RESONANCE IMAGING (fMRI) AND FUNCTIONAL NEAR-INFRARED SPECTROSCOPY (fNIRS)

A related category I will mention briefly is functional magnetic resonance imagery. It goes much deeper into that brain and gives a three-dimensional scan. It is most definitely not “consumer priced. But a related device category leverages infrared technology.

Hyperfine was present at CES 2020 with a fNIRS device priced “under $100,000”, and so not a low-cost device, but with a smaller form factor allowing a portable machine wheeled to a point of need, such as an emergency room, where traditional fMRI is not possible. Some cases, like stroke care, benefit very much from earlier assessment and treatment. At $100K, it’s not clear why this device was at a consumer electronics show.

OBELAB is a Korean company also at CES with a fNIRS device, but in a headband (albeit heavier) form factor. Initially targeted at the R&D lab market and medical device market, a “NIRSIT LITE” product is also in development targeting the wellness device consumer market, and reducing the price from $50,000 to only $39,000 according to a spokesman at CES.

OpenWater is a start-up targeting a 1,000X reduction in cost for fMRI. It emerged from stealth mode with an fNIRS device.

It is one of several very well-funded start-ups. For comparison, it is worth taking an investment interest in some of the other Neurotech companies in Table 1.

TABLE 1 NEUROTECH INVESTMENT

Interaxon (Muse) 28.8 M USD

Emotiv 0.12 M USD

G.tec Medical 1.9 M EUR

NextMind 4.6 M USD

BrainCo 6.0 M USD

MindAffect 1.0 M EUR

Neurable 9.0 M USD

SensAI Angel funded

Source: Crunchbase

An order of magnitude greater amount of money is following some tech rock stars. Press darlings Neuralink (Elon Musk) and OpenWater (Mary Lou Jepsen), with their celebrity CEOs, are still in pretty early development stages, and have pretty ambitious goals, and most important aren’t pursuing a direct-to-consumer play. Bryan Johnson, who sold a payments app to eBay, is self-funding Kernel, which started as a surgically implanted chip but has pivoted to a “helmet covered with sensors”, but his real business model is selling sample brain data to private companies.

TABLE 2 INVESTMENT — LARGER NEUROTECH PLAYERS

Kernel 100 M US

Neuralink 158 M US

OpenWater 28 M US